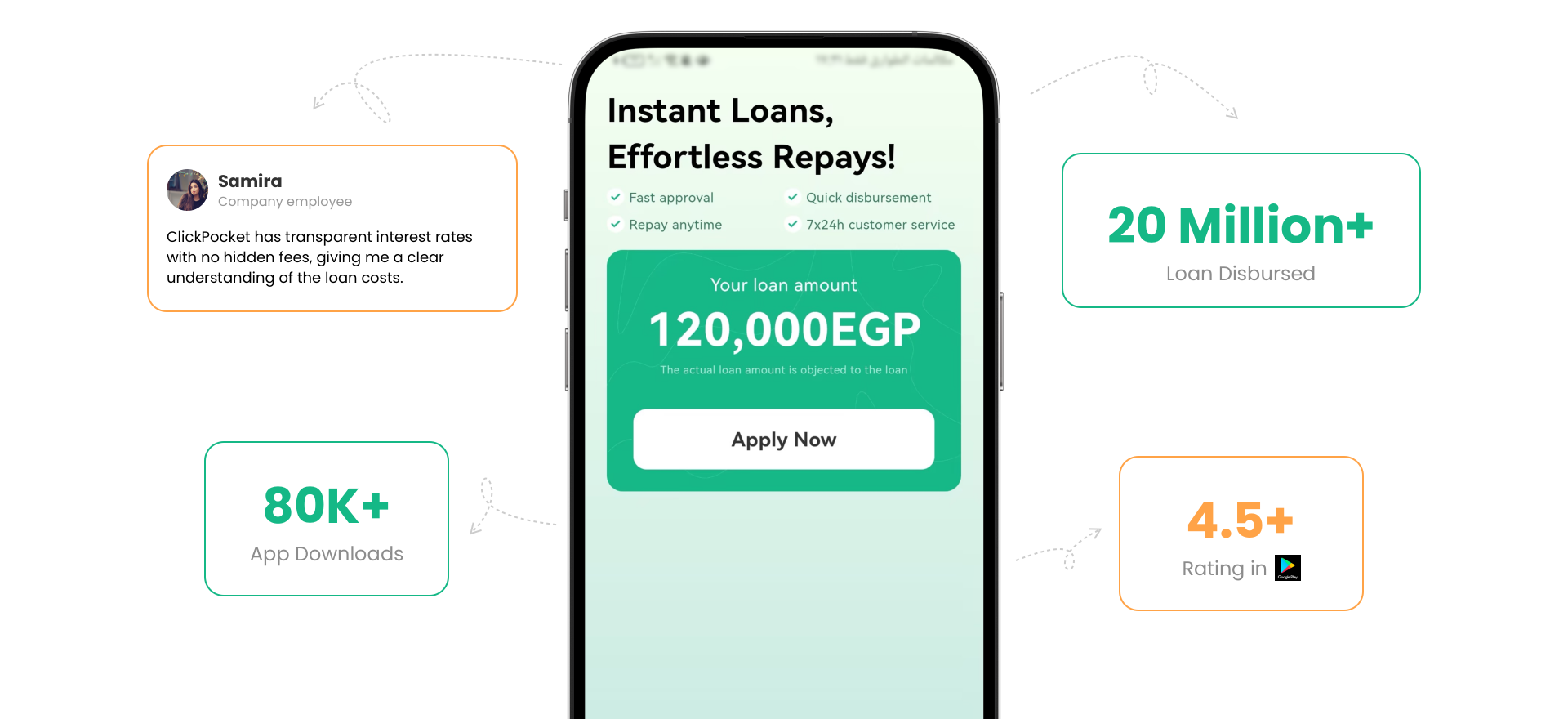

Select Us for Safe, Reliable Speed

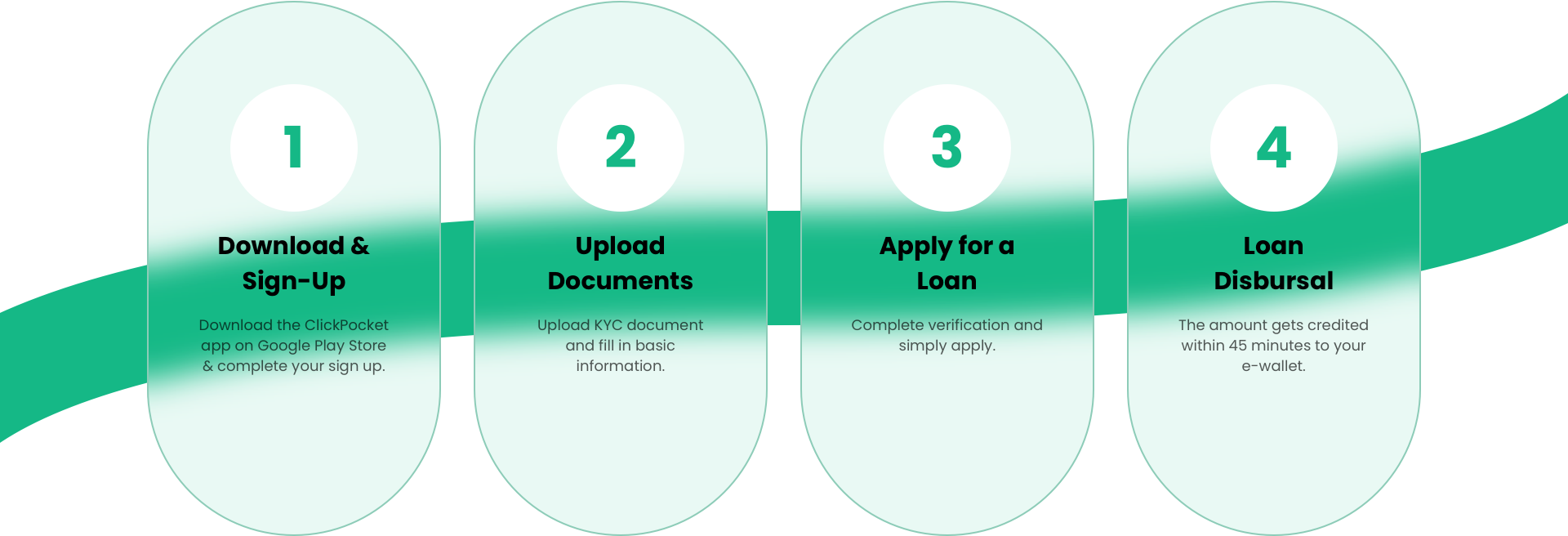

Exploring Our Sequential Steps

Our short-term loan app will solve your problems. The app is simple and convenient to use, requiring no complicated

process - you can get approved quickly by just completing a few steps of the online application.

Questions? Look Here

If you have any inquiries or need assistance, this is the place to find answers. Dive in and explore our

comprehensive

FAQ section for all the information you seek.

-

Manual Credit Increases:- Not offered; limits are systematically determined

- Maintain good credit standing and timely repayments for potential increases -

Credit Amount Calculation:1. Basic credit: Based on verified submitted information

2. Additional credit: From external credit evaluation

Total credit = Basic credit + Additional credit

-

Credit Evaluation Frequency:1. With each loan application

2. Through periodic random assessments

-

Credit Amount Fluctuations:- Limits are dynamic

- Timely repayments and proper usage may increase limits

- External assessments can impact credit amount -

Post-Repayment Credit Limit Reductions:- Credit amounts based on multi-dimensional evaluations

- Limit adjustments may occur after repayment

- Consistent, timely payments typically lead to credit increases over time -

Payment Date Changes:- Loan repayment dates are fixed and cannot be altered

-

Loan History Deletion:- Individual loan history deletions not supported

- Account closure removes loan history but doesn't reset credit line

- Credit evaluation may be retained for a period

Contact Us

Mail us: customercare@finspa.xyz

Shobak Seti, Zagazig, Sharqiya Governorate 7142101, Egypt

Copyright © 2024, FINSPA